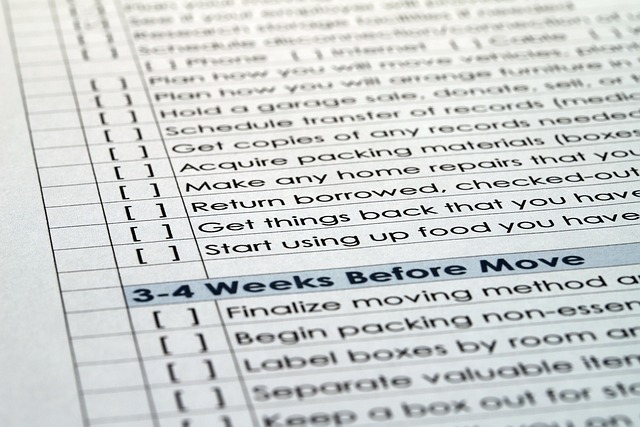

Understanding your financial situation is key to successful financial planning in South Africa, involving tracking income and expenses to set realistic goals. Define short-term and long-term aspirations, build a balanced budget using apps or spreadsheets, and prioritize saving with consistent contributions. Unravel investment basics, assess risk tolerance, strategize for long-term success, and manage debt effectively by prioritizing high-interest debts, keeping credit utilisation low, and reviewing your budget regularly. A Financial Planning Checklist South Africa acts as a valuable guide throughout these steps.

Embark on your financial journey with our comprehensive guide tailored for South African beginners. Navigating your first steps towards financial freedom can be daunting, but with the right tools, it becomes manageable. This article serves as your financial planning checklist, covering essential aspects from understanding your income and expenses to setting goals, creating a budget, saving strategically, investing wisely, managing debt, and boosting your credit score.

- Understanding Your Financial Situation: Tracking Income and Expenses

- Setting Clear Financial Goals: Short-Term vs Long-Term

- Building a Budget: A Practical Step-by-Step Guide

- Saving Strategies for Beginners: Starting Small, Growing Big

- Investing Basics: Demystifying Market Options in South Africa

- Debt Management and Credit Score Health: Tips for Financial Freedom

Understanding Your Financial Situation: Tracking Income and Expenses

Understanding your financial situation is a crucial first step in any financial planning checklist for South Africa. It involves tracking your income and expenses to gain clarity on where your money is going. Start by listing all sources of regular income, including salaries, investments, or any side hustles. Then, categorise and record your monthly expenses – from rent and utilities to groceries, entertainment, and debt repayments. This process will help you identify areas where you may be overspending and highlight opportunities for budget adjustments.

Once you have a comprehensive overview, analyse your financial data to set realistic goals. Are there unexpected costs that often creep up? Can certain expenses be reduced or eliminated? By being mindful of these aspects, you can create a sustainable budget, ensuring that you live within your means while still meeting your financial obligations and saving for the future.

Setting Clear Financial Goals: Short-Term vs Long-Term

When starting on your financial planning journey, one of the first steps is to define your goals. This involves a distinction between short-term and long-term aspirations. Short-term goals are those that you aim to achieve within a year or less, such as saving for a holiday or buying a new car. They’re important for immediate financial security and satisfaction but should also be part of a larger strategy.

Long-term objectives, on the other hand, span over years and even decades, like retirement planning or your children’s education. A Financial Planning Checklist South Africa can guide you in setting these goals effectively. It involves evaluating your current financial situation, identifying what you want to achieve, and mapping out a realistic roadmap to reach those targets. This dual focus ensures that while you’re managing daily expenses and short-term needs, you’re also building a robust foundation for your future financial well-being.

Building a Budget: A Practical Step-by-Step Guide

Building a budget is a fundamental step in your financial planning journey, and it’s a practical way to gain control over your finances. Start by listing all your income sources, including salaries, investments, or any other regular cash inflows. Next, track your expenses meticulously for a few months to understand your typical outgoings. Categorize these expenses into fixed (like rent or mortgage) and variable (groceries, entertainment) costs.

Once you have this breakdown, create a realistic budget by allocating money to each category based on your priorities. Remember, a budget isn’t about strict rules but finding a balance. Consider using budgeting apps or spreadsheets for easy tracking. A Financial Planning Checklist South Africa can offer valuable guidance on common budgeting pitfalls and best practices tailored to your region, ensuring you set achievable financial goals.

Saving Strategies for Beginners: Starting Small, Growing Big

Saving is a crucial component of financial planning, and for beginners, it’s all about starting small and building momentum. Every Rand counts when you’re first beginning your savings journey. Consider implementing simple strategies like setting up direct deposits into a dedicated savings account from your salary or allocating a fixed amount each month towards savings goals. Start with what you can afford, whether that’s R100 or R500 per month, and gradually increase as your financial situation allows. Remember, consistent saving is key; it’s better to save regularly at a smaller amount than to save nothing at all.

Over time, these small savings will add up, creating a solid financial foundation. As you become more comfortable with budgeting and tracking expenses, explore options for growing your savings faster. This could involve increasing your monthly contributions, exploring high-interest savings accounts, or investing in diverse financial products tailored to your risk appetite and goals. A Financial Planning Checklist South Africa can be a valuable tool at this stage, helping you assess where you are, where you want to be, and the steps required to bridge the gap.

Investing Basics: Demystifying Market Options in South Africa

Investing in the market can seem daunting, but understanding the basics is a crucial step in your financial planning journey. In South Africa, investors have a variety of options to choose from, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Each option offers unique advantages and risk levels, making it essential to do your research before diving in. A simple Financial Planning Checklist for beginners could include assessing your risk tolerance, setting clear financial goals, and deciding on a long-term investment strategy that aligns with your aspirations.

Consider starting small and diversifying your portfolio as you gain experience. Keep an eye on market trends and economic news to make informed decisions. Remember, investing isn’t just about growing your money; it’s also about preserving it. By familiarizing yourself with these basics, you’ll be better equipped to navigate the South African market and work towards achieving your financial dreams.

Debt Management and Credit Score Health: Tips for Financial Freedom

Debt management is a crucial aspect of financial planning in South Africa, where many individuals carry significant debt burdens. Effective debt management involves understanding and prioritising your debts, starting with high-interest or essential payments like utilities. Create a financial planning checklist that includes strategies to pay off debts faster by allocating surplus income towards them. Regularly reviewing and adjusting your budget to accommodate debt repayment is key.

Credit score health is another critical component of financial freedom. In South Africa, maintaining a good credit score can open doors to better loans, lower interest rates, and improved access to financing. Keep your credit utilisation low by not maxing out cards, and ensure timely payments. Regularly checking your credit report for errors or fraudulent activity will help protect your financial standing. Incorporate these debt management practices into your South African financial planning checklist to achieve long-term financial stability and security.

Financial planning is a journey that begins with understanding your current situation and setting clear goals. By tracking your income and expenses, you gain valuable insights into where your money goes. From there, creating a budget becomes a powerful tool for managing your finances effectively. South Africa’s financial landscape offers various investment options, making it easier to grow your wealth over time. Remember, saving and investing early, even in small amounts, can lead to significant financial freedom. Use this comprehensive Financial Planning Checklist as a guide to navigate your monetary future confidently.